Economic statistics for the past week revealed that the Estonian economy grew a lot more last year than was previously thought.

Economic statistics for the past week revealed that the Estonian economy grew a lot more last year than was previously thought.

The growth of GDP in the second quarter can also be regarded as being good. At the same time, there are a number of issues plaguing the economy – low productivity, rapid wage growth and fragile exports – which lead to caution with regards to the future.

Statistics Estonia adjusted economic growth upwards

On Tuesday of this week, Statistics Estonia published more detailed information on the accounting of the gross domestic product. According to the corrected data, in Q2 the Estonian economy grew by 2% when compared to the same time last year, which is 0.1% higher than the initial estimate. Revision of the data from the previous periods, however, resulted in an even bigger surprise – namely the rating of the economic growth in 2014 was raised significantly. According to the new data, in 2014 GDP increased 2.9% instead of the previously thought 2.1%. The system of national accounts is complicated and it is common that the ratings are revised when more detailed data is sourced, but correcting them to such an extent is uncommon.

In Q2 the biggest contribution to economic growth was made by net taxes on products, more precisely a significant increase in the collection of value-added tax, which in turn was supported by increased private consumption and tax supervision. In terms of fields of activity, as expected, the biggest contribution to economic growth was made by wholesale and retail trade. When compared to the same period last year, private consumption has increased by 5.4%.

The rapid growth of real wages and low energy prices have left people with more disposable income, making it possible to consume more; mainly expenditures on food and recreation have increased. A strong decline in added value in the fields of transport, storage and the processing industry had a negative effect on economic growth. Russia plays a significant role in the decline of both these sectors, as transit and export in that direction has decreased significantly.

Out of the more important trade partners for Estonia, year-on-year the GDP of Sweden experienced the fastest rate of growth at 2.9%; however, the economy of our southern neighbours in Latvia grew by a solid 2.7%. Economic growth in Lithuania, however, has not met expectations, which is why both SEB as well as the central bank of Lithuania have significantly lowered this year’s growth forecast. Based on the seasonally adjusted data, the Finnish economy was at precisely the same level in Q2 as the same time last year, which is the poorest result among all European Union Member States.

The economy of the union as a whole grew by 1.9% in Q2. In order to kick-start the economy, the government of Finland has launched extensive workforce reforms, which should increase the country’s competitiveness. High wages that do not correlate with productivity are regarded as being one of the main problems with the Finnish economy. As it is difficult to raise the added value created by companies or to decrease the wages paid, then the reform is targeted towards extending the actual time worked by the Finns, to bring the accounted hourly fee to a competitive level.

The productivity of the labour force has declined

Productivity of the labour force per person engaged is in decline for the third consecutive quarter. When in Q1 the seasonally adjusted actual indicator decreased by 2%, then in Q2 it fell 0.1%. At the same time, the indicator expressing the relation between pay and productivity, unit labour cost, has increased rapidly. The unit labour cost increased its pace in the second half of 2013; however, in 2015, the growth rate has increased even further, rising by 4.9% in Q1 and 3.6% in Q2.

This is a serious challenge for Estonia’s international competitiveness, because we are not able to create enough value for the increasing expectations for wages. In recent years, the increase in the unit labour cost in Estonia has been the fastest in the European Union, surpassing by far our competitors Latvia and Lithuania. Last year, the unit labour price was 16% higher than in 2010, while growth amounted to only 10% in the other Baltic States.

Figure 1. Productivity of the workforce and unit labour cost per person engaged

Unemployment has reached its lower limit

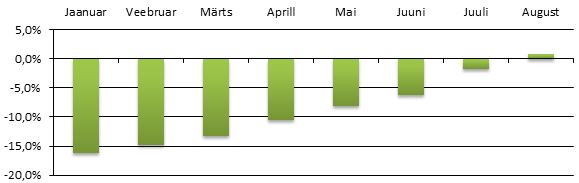

Recent data from the Estonian Unemployment Insurance Fund raises the question of whether the next few months will bring about a bigger increase in unemployment than regular seasonality would suggest. While the number of unemployed people decreased in August when compared to July of this year, then when compared to the same month in 2014, the number of unemployed people grew by 185 people, or 0.7%. In total there are 25,409 people registered with the Estonian Unemployment Insurance Fund.

The number of unemployed people also grew in July, when compared to June. The pace of the decline in the number of registered unemployed people has slowed down over the course of the whole year. On the one hand, we are approaching a situation where all the people, who want to and are able to, have been engaged. On the other hand, the discord between the growing salaries and declining business profits is becoming increasingly clearer, which is why labour-consuming enterprises need to optimise their activities. As employment peaks in the summer months, a slight increase in registered unemployment in the autumn is normal; however, due to the pressure on wages, there is a danger that the growth this year will be much steeper than usual.

Figure 2. Changes in the number of unemployed people in 2015 when compared to the same month last year.

Steep fall in exports

In June, Estonia’s exports grew by 3%, their highest level this year, followed by a steep decline in July. In total, the exporting of goods fell by 6% or EUR 57 million. The main reason for this decline was the significant slowdown in exports in the direction of Sweden (growth of only 1% in July) and a big decline in the direction of Latvia (- 16%). As is known, Estonia’s exports to Sweden are closely tied to the internal demands of a large company engaged in the manufacturing of telecommunications equipment, and as revealed by the industrial production statistics for July, it was precisely a decline in the export of mobile communications electronics which curbed growth.

On the positive side, the export of wooden houses from Estonia to Sweden has more than doubled, and the sales of furniture and mattresses have also experienced rapid growth. The year-on-year decline of exports towards Latvia was mostly impacted by the unusually large volume of exports in July of last year. Due to the lower comparison base, in June and July the decline of exports towards Russia is slowing down, while exports to Germany and Norway is growing rapidly.

Consumer prices still falling

The further decline in the price of oil has had an impact on the wallets of Estonian consumers. Similarly to the previous month, in August consumer prices fell by 0.3%. There has basically been a decline in the consumer price index lasting for the whole year, with May being the only exception, when the consumer price index increasing by 0.1%. Cheap fuel decreases expenditures on transport, which is one of the most important components of the consumer price index. Also, the impact of cheap fuel is also indirectly reflected in other groups of goods. As the share of transport expenses is smaller in the more well-off countries in Western Europe, consumer prices in the euro zone grew 0.2% in August.

The price of oil being lower than estimated has also suppressed inflation in the euro zone, and several institutions have lowered their projections for the increase in prices during the current and following year. In Estonia, the first signs of inflation should probably appear in November and December of this year, mainly due to the lower comparison basis. It may be recalled that the biggest fall in fuel prices occurred at the end of last year. A moderate reappearance of inflation is expected next year in Estonia.