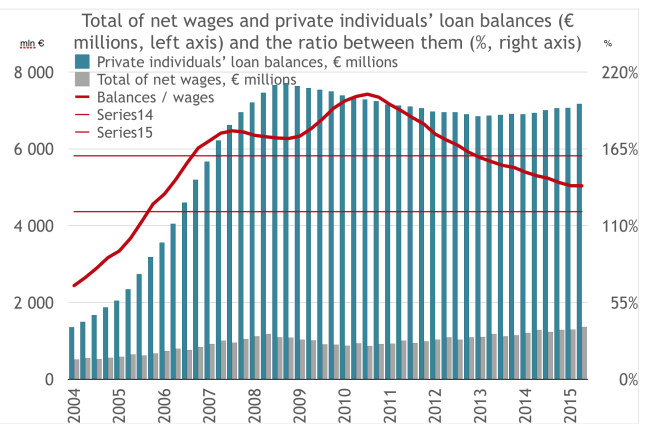

Balances on loan private individuals’ loans in Estonia have begun to grow at accelerating rates. According to the Bank of Estonia, last August the balance on private individuals’ loans stood at 7.23 billion euros, up 3.5% year on year. Growth in loan balances is being driven by the growing turnover of loans. In the past six months, growth in the annual turnover of loans has been in the quite high range of 13 to 21 per cent.

The situation of rapid growth in loan balances is increasing indebtedness. This, in turn, is creating risk that banks will apply brakes on the issuing of home loans. That, similarly, will slow the rate of transactions completed on the real estate market and cause prices, which have remained stable, to fall.

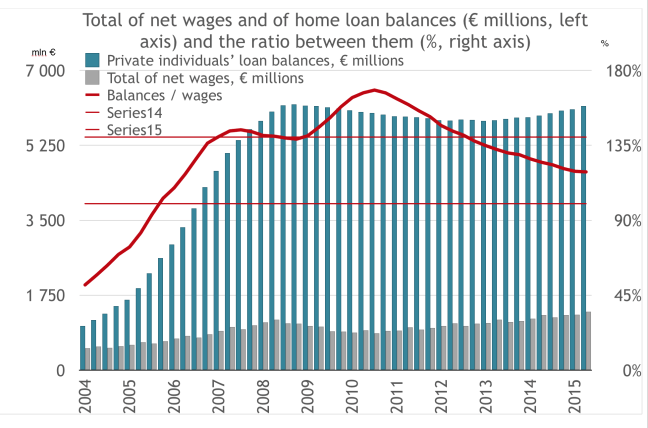

The rise in balances on private individuals’ loans and on home loans is outpacing growth in the economy, which is raising relative indebtedness. However, rise loan balances is outpaced by mean growth in wages. In addition, loan balances are rising at a slower pace than aggregate payroll, which is the amount of money out which consumers are servicing their loans. Accordingly, for the time being, there is no reason for concern over the accelerating rise in loan balances.

A separate issue is sustainability in the rise of incomes. If growth in wages slows down but loan balances continue to increase at the current rate, indebtedness will begin to rise and may turn into a challenging problem in the event of setbacks for the economy, leaving its mark on the real estate market.

http://tallinn-property.goodsonandred.com/2015/10/statistics-growth-in-the-aggregate-total-of-wages-outpacing-loan-balances/