Hepsor AS (registry code 12099216, address Järvevena tee 7b, 10112, Tallinn, Estonia; Hepsor) announces a bond programme (Programme) in the total amount of EUR 20 million and a public offering (hereinafter Offer) of the first series of bonds under the Programme. As part of the offer, Hepsor will raise up to EUR 6 million, with the possibility of increasing the volume to EUR 8 million. The offer will be conducted on the basis of the main prospectus (hereinafter Prospectus) prepared by Hepsor and approved by the Estonian Financial Supervision Authority on 10 November 2025, and published on the websites of Hepsor and the Estonian Financial Supervision Authority on the date of this announcement. The Offer is intended for retail and institutional investors operating in Estonia, Latvia, and Lithuania.

Hepsor AS (registry code 12099216, address Järvevena tee 7b, 10112, Tallinn, Estonia; Hepsor) announces a bond programme (Programme) in the total amount of EUR 20 million and a public offering (hereinafter Offer) of the first series of bonds under the Programme. As part of the offer, Hepsor will raise up to EUR 6 million, with the possibility of increasing the volume to EUR 8 million. The offer will be conducted on the basis of the main prospectus (hereinafter Prospectus) prepared by Hepsor and approved by the Estonian Financial Supervision Authority on 10 November 2025, and published on the websites of Hepsor and the Estonian Financial Supervision Authority on the date of this announcement. The Offer is intended for retail and institutional investors operating in Estonia, Latvia, and Lithuania.

The main conditions of the Offer

| Issuer | Hepsor AS |

| Security | EUR 9.50 Hepsor AS bond 25-2028 |

| Security type | Unsecured and unsubordinated bond |

| Serial number | 1 |

| ISIN | EE0000002749 |

| Type of offering | Public offering intended for retail and institutional investors operating in Estonia, Latvia, and Lithuania. |

| Issue volume | EUR 6 million, with the possibility of it increasing up to EUR 8 million |

| Nominal value | EUR 1,000 |

| Interest rate | 9.50 % per annum |

| Financial covenant | – The share of equity in assets must always be at least 20%;

– Ensure minimum liquidity at all times to make at least the next interest payment. |

| Interest payments | Quarterly (26 February, 26 May, 26 August, and 26 November) |

| Subscription period | 12 November 2025, 10:00 – 21 November 2025, 15:30 |

| Value Date | 26 November 2025 |

| Maturity date | 26 November 2028 |

| Request for admission to trading | List of Baltic bonds on the Nasdaq Tallinn Stock Exchange |

| First trading day | 27 November 2025 or a date close to it |

| Prospectus approved | 10 November 2025 by the Estonian Financial Supervision Authority |

| Arranger | AS LHV Pank |

| Legal Adviser | Ellex Raidla Law Firm |

Bonds are unsecured and unsubordinated. This means that they are not secured by any pledged assets or other collateral, and investors’ claims do not have priority over Hepsor’s other liabilities.

The proceeds from the offer will be used to refinance Hepsor’s existing EUR 6 million loan agreement with AS LHV Pank. In the event that Hepsor decides to increase the volume of the first series issue, the funds remaining from the refinancing will be directed towards the financing of real estate development projects in Hepsor’s development portfolio.

Further details of the offer are described in the Prospectus and in the summary of the Prospectus.

Indicative schedule of the offer

| Beginning of the subscription period | 12 November 2025 at 10:00 |

| End of the subscription period | 21 November 2025 at 15:30 |

| Disclosure of Offer results | 24 November 2025 or a date close to it |

| Offer settlement | 26 November 2025 or a date close to it |

| First day of trading in the list of Baltic bonds on the Nasdaq Tallinn Stock Exchange | 27 November 2025 or a date close to it |

Submission of subscription orders

In order to subscribe to the bonds as part of the Offer, the investor must have a securities account with the account operator of the Nasdaq CSD SE Estonian branch or with a financial institution that is a member of Nasdaq Riga or Nasdaq Vilnius stock exchange.

An investor wishing to subscribe to the bonds must contact the account operator that manages the securities account of the respective investor or the relevant financial institution and submit a subscription order in the form below to mark the bonds during the offer period. By submitting a subscription order, the investor authorises the account operator or the relevant financial institution that manages the current account associated with the investor’s securities account to immediately block the total amount of the transaction in the investor’s current account until settlement is completed or the funds are released in accordance with the conditions set out in the Prospectus.

| Holder of the securities account: | Investor’s name |

| Securities account: | Investor’s securities account number |

| Account operators: | Name of the investor’s account operator: |

| Security: | EUR 9.50 Hepsor AS bond 25-2028 |

| ISIN code: | EE0000002749 |

| Number of securities: | the number of bonds to which the investor wants to subscribe |

| Price (per bond): | EUR 1,000 |

| Transaction amount: | the number of bonds to which the investor wants to subscribe, multiplied by the price (per bond) |

| Counterparty to the transaction: | Hepsor AS |

| Securities account of the counterparty to the transaction: | 99102109519 |

| Account operator for the counterparty to the transaction: | AS LHV Pank |

| Transaction value date: | 26 November 2025 |

| Type of transaction: | ‘transfer of securities against payment’ |

Admission of Hepsor Bonds to Trading

Hepsor requests that the operator of the Tallinn Stock Exchange list the bonds issued as part of the Offer in the Baltic Bond List. Although Hepsor makes every effort to ensure that its bonds are admitted to trading, Hepsor cannot guarantee the admission of its bonds to trading.

Availability of the Prospectus

The prospectus and the summary of the Prospectus have been made public and are available in electronic form on Hepsor’s website at https://hepsor.ee/en/for-

Investor Event

Hepsor invites all interested parties to an event presenting Hepsor and the Offer on 13 November 2025 at 16:00 at Manufaktuuri 3, Tallinn (registration: https://forms.gle/

Before investing in bonds, we ask that you familiarise yourself with the Prospectus, its summary, the bond terms and conditions, and the final terms and conditions in their entirety, and consult with an expert, if necessary.

Summus Capital OÜ has released its consolidated financial results for the third quarter of 2025, highlighting stable financial performance, a strong balance sheet and continued portfolio optimization across the Baltic region and Poland.

Summus Capital OÜ has released its consolidated financial results for the third quarter of 2025, highlighting stable financial performance, a strong balance sheet and continued portfolio optimization across the Baltic region and Poland.

Pärnu linnavalitsus otsustas korraldada valikpakkumise Tallinna mnt 72 kinnistule 50 aastaks hoonestusõiguse seadmiseks, võitja peab kinnistule ehitama jäähalli ja seda teenindavad rajatised.

Pärnu linnavalitsus otsustas korraldada valikpakkumise Tallinna mnt 72 kinnistule 50 aastaks hoonestusõiguse seadmiseks, võitja peab kinnistule ehitama jäähalli ja seda teenindavad rajatised.

Kinnisvaraturul on justkui märgata elavnemist ja puutun nii maakleritöös kui ka eraelus pidevalt kokku küsimustega stiilis “Mis sa arvad, kas järgmine aasta kinnisvara hinnad tõusevad?”, “Millal oleks õige aeg osta/müüa kinnisvara”, “Millal muutub kinnisvaraturg jälle investoritele atraktiivseks?” jms. Nagu paljud minu kolleegid ja ka teised kinnisvaravaldkonna arvamusliidrid usuvad, pakun ka mina, et 2026. aasta ei too kaasa murrangulist pöördepunkti kinnisvara hindades.

Kinnisvaraturul on justkui märgata elavnemist ja puutun nii maakleritöös kui ka eraelus pidevalt kokku küsimustega stiilis “Mis sa arvad, kas järgmine aasta kinnisvara hinnad tõusevad?”, “Millal oleks õige aeg osta/müüa kinnisvara”, “Millal muutub kinnisvaraturg jälle investoritele atraktiivseks?” jms. Nagu paljud minu kolleegid ja ka teised kinnisvaravaldkonna arvamusliidrid usuvad, pakun ka mina, et 2026. aasta ei too kaasa murrangulist pöördepunkti kinnisvara hindades.

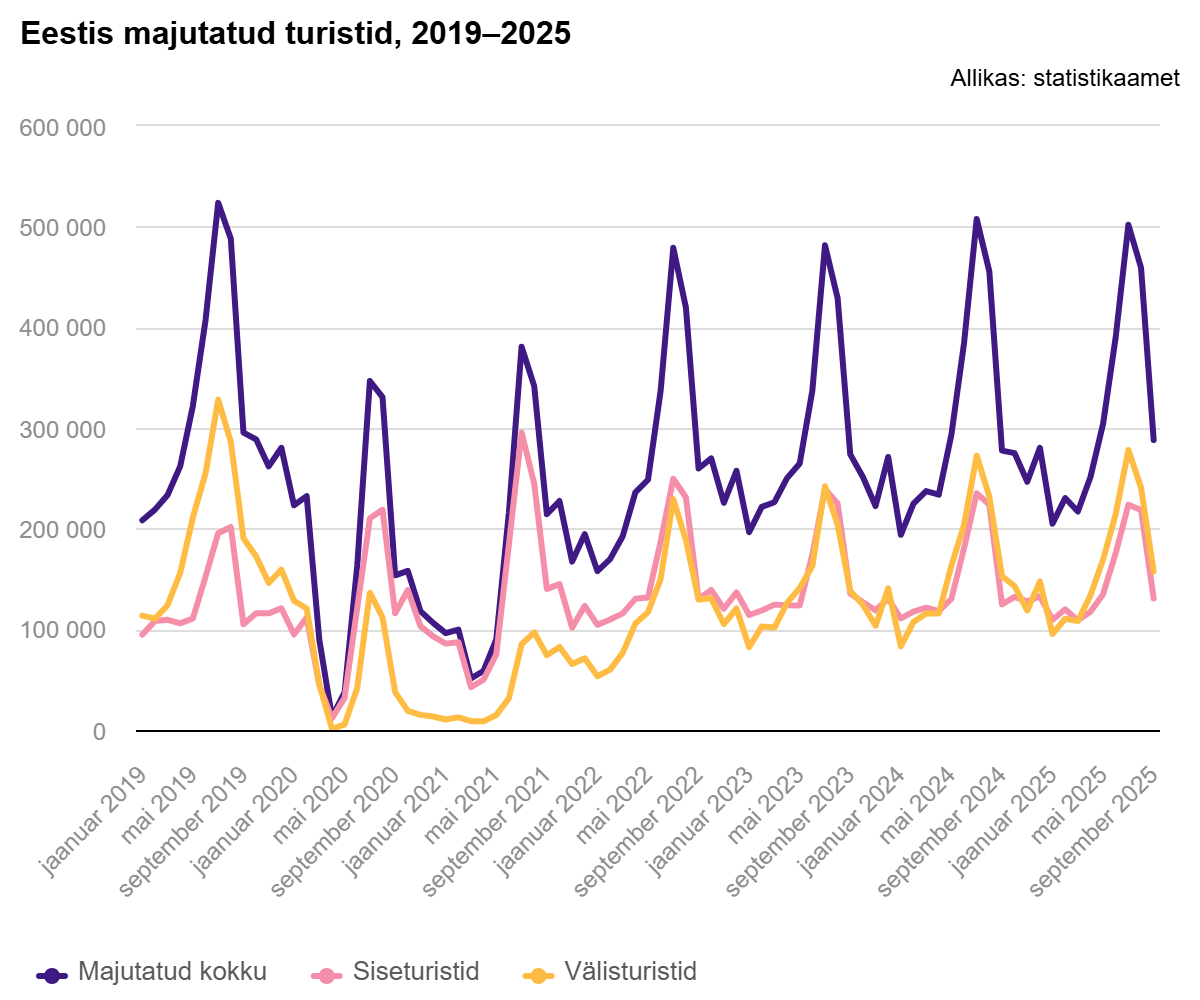

Statistikaameti andmetel peatus 2025. aasta septembris majutusettevõtetes 288 000 turisti, keda oli 4% rohkem kui aasta varem samal kuul. Välisturiste oli 3% ja siseturiste 5% rohkem kui mullu, Soome turistide arv vähenes viiendat kuud järjest.

Statistikaameti andmetel peatus 2025. aasta septembris majutusettevõtetes 288 000 turisti, keda oli 4% rohkem kui aasta varem samal kuul. Välisturiste oli 3% ja siseturiste 5% rohkem kui mullu, Soome turistide arv vähenes viiendat kuud järjest.

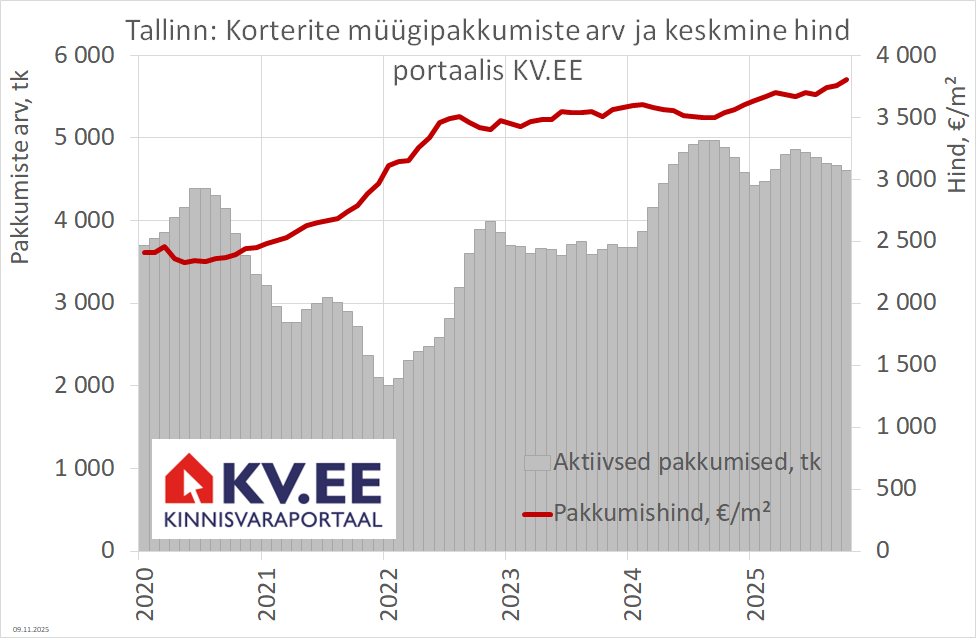

Tallinna korterite müügipakkumiste arv väheneb ja keskmine pakkumishind kerkib. Osalt on tegemist hooajaliste ja n-ö tehniliste arengutega. Teisalt paistab, et elamispindade turu pendel on ühes äärmuses ära käinud ja hakkab tasakaalupunkti suunas tagasi liikuma, kommenteeris elamispindade turu arenguid kinnisvaraportaali KV.EE juhataja Tarvo Teslon.

Tallinna korterite müügipakkumiste arv väheneb ja keskmine pakkumishind kerkib. Osalt on tegemist hooajaliste ja n-ö tehniliste arengutega. Teisalt paistab, et elamispindade turu pendel on ühes äärmuses ära käinud ja hakkab tasakaalupunkti suunas tagasi liikuma, kommenteeris elamispindade turu arenguid kinnisvaraportaali KV.EE juhataja Tarvo Teslon.

Luminor tuli välja õpetajatele ja teistele haridustöötajatele suunatud eripakkumisega, millega pakutakse sihtgrupile turu parimaid kodulaenu tingimusi – fikseeritud intressi 1,39%, millele lisandub euribor ning puudub lepingutasu. Pakkumine kehtib nii täis- kui osakoormusega töötavatele haridustöötajatele, samuti tähtajalise lepinguga töötajale.

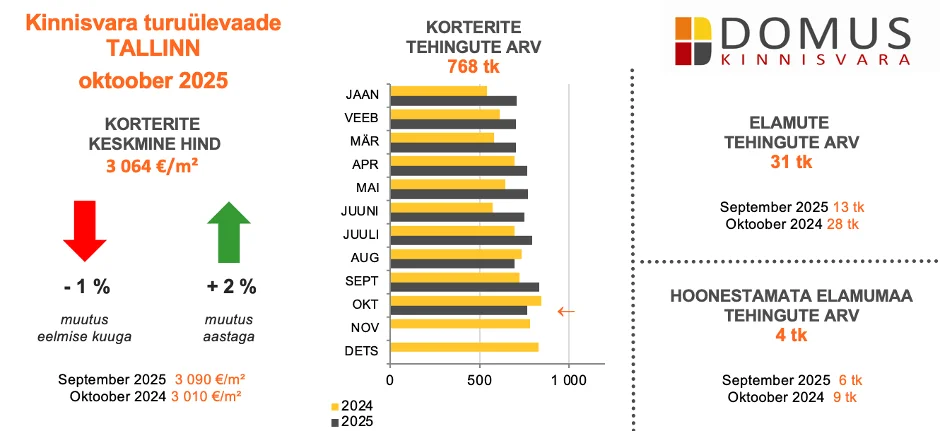

Luminor tuli välja õpetajatele ja teistele haridustöötajatele suunatud eripakkumisega, millega pakutakse sihtgrupile turu parimaid kodulaenu tingimusi – fikseeritud intressi 1,39%, millele lisandub euribor ning puudub lepingutasu. Pakkumine kehtib nii täis- kui osakoormusega töötavatele haridustöötajatele, samuti tähtajalise lepinguga töötajale. Allikas: Maa- ja Ruumiamet

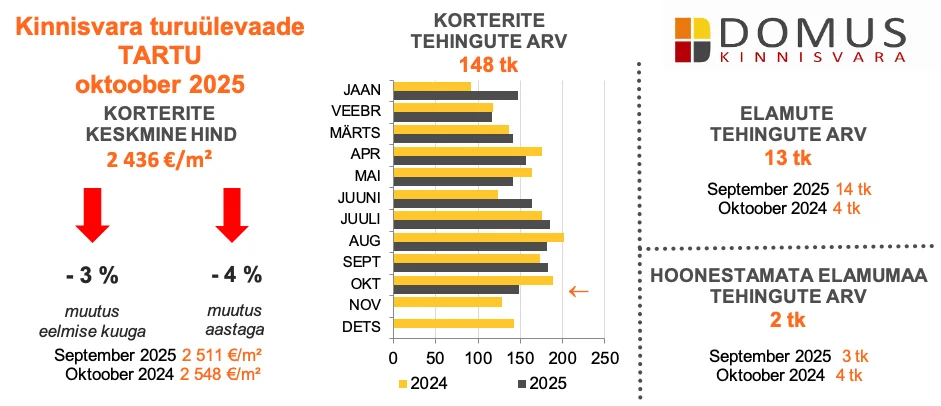

Allikas: Maa- ja Ruumiamet Allikas: Maa- ja Ruumiamet

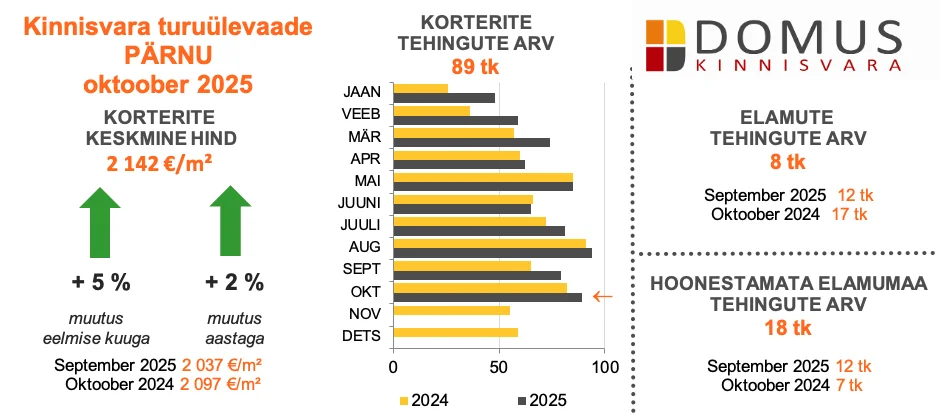

Allikas: Maa- ja Ruumiamet Allikas: Maa- ja Ruumiamet

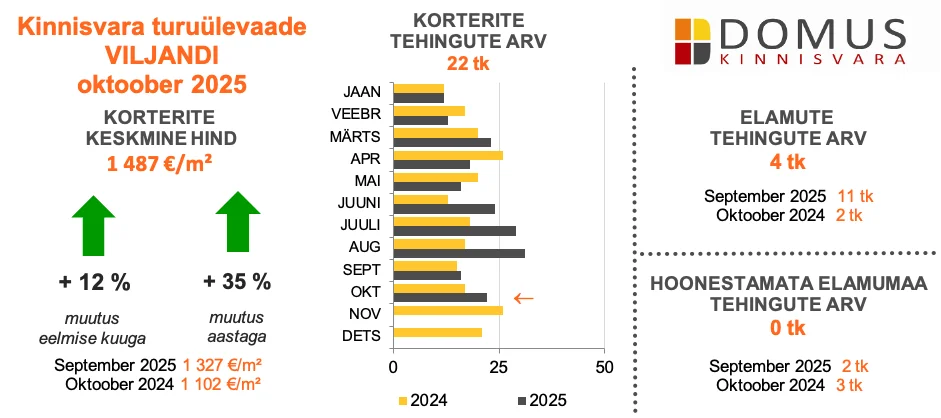

Allikas: Maa- ja Ruumiamet Allikas: Maa- ja Ruumiamet

Allikas: Maa- ja Ruumiamet

20.11.2025 toimub Kinnisvarakoolis koolitus “

20.11.2025 toimub Kinnisvarakoolis koolitus “

EfTEN Real Real Estate Fund AS-i 08.04.2025 toimunud aktsionäride üldkoosolekul andsid aktsionärid üheks aastaks alates üldkoosoleku otsuse vastuvõtmisest fondi nõukogu pädevusse fondi aktsiakapitali suurendamise otsustamise avaliku ja/või suunatud pakkumiste läbiviimise teel, välistades olemasolevate aktsionäride märkimise eesõiguse.

EfTEN Real Real Estate Fund AS-i 08.04.2025 toimunud aktsionäride üldkoosolekul andsid aktsionärid üheks aastaks alates üldkoosoleku otsuse vastuvõtmisest fondi nõukogu pädevusse fondi aktsiakapitali suurendamise otsustamise avaliku ja/või suunatud pakkumiste läbiviimise teel, välistades olemasolevate aktsionäride märkimise eesõiguse.

10. novembril 2025 asutasid AS Merko Ehitus kontserni kuuluv OÜ Merko Kodud ning AS Krulli Kvartal 50:50 ühisettevõtte Krulli Kodud OÜ, eesmärgiga koostöös arendada Põhja-Tallinnas asuva Krulli kvartali eluhooneid.

10. novembril 2025 asutasid AS Merko Ehitus kontserni kuuluv OÜ Merko Kodud ning AS Krulli Kvartal 50:50 ühisettevõtte Krulli Kodud OÜ, eesmärgiga koostöös arendada Põhja-Tallinnas asuva Krulli kvartali eluhooneid.

Täna Statistikaameti poolt avaldatud tarbijahinnaindeks kasvas aastaga 4,6%, mis on natuke rohkem kui näitas meile esialgne kiirhinnang (4,4%). Kuises võrdluses hinnad ei muutunud.

Täna Statistikaameti poolt avaldatud tarbijahinnaindeks kasvas aastaga 4,6%, mis on natuke rohkem kui näitas meile esialgne kiirhinnang (4,4%). Kuises võrdluses hinnad ei muutunud.