The Group’s consolidated revenue for the fourth quarter of 2025 amounted to 4.5 million euros (Q4 2024: 10.5 million euros), while the consolidated revenue for the reporting year was 35.4 million euros (2024: 38.4 million euros).

The Group’s consolidated revenue for the fourth quarter of 2025 amounted to 4.5 million euros (Q4 2024: 10.5 million euros), while the consolidated revenue for the reporting year was 35.4 million euros (2024: 38.4 million euros).

The Group recorded a net loss of 0.5 million euros for the fourth quarter (Q4 2024: net profit of 1.0 million euros), of which the net loss attributable to the owners of the parent company was 0.5 million euros (Q4 2024: net profit of 1.0 million euros). The Group’s net profit for 2025 was 1.0 million euros (2024: 2.1 million euros). The net profit attributable to the owners of the parent company for the reporting year was 0.4 million euros (2024: 0.4 million euros).

Compared with the previous year, the Group’s revenue and profitability in 2025 were affected by a decrease in the number of apartments handed over to customers – 141 apartments (2024: 194). Profitability was negatively impacted by lower profit margins of the development projects sold, which in 2025 stood at 16.9% (2024: 17.8%) and an increase in marketing expenses. Marketing expenses amounted to 1,3 million euros in 2025 (2024: 0.9 million euros). The increase in expenses was primarily driven by the growth in the number and scale of projects on sale, which led to more intensive sales and marketing activities. The Group’s finance costs and personnel expenses remained at the same level as in the previous year.

On 21 November 2025, the public offering of the first series under the bond programme of Hepsor AS was successfully completed. The initial issue volume was 6 million euros; however, the offering was 1.4 times oversubscribed and due to strong investor demand, the volume was increased to 8 million euros. A total of 1,079 investors from Estonia, Latvia and Lithuania participated in the offering. The bonds carry a fixed annual interest rate of 9.50%, and the first interest payment will be made on 26 February 2026.

In 2025, we expanded the Group’s development portfolio with three new plots of land, with development activities planned in multiple phases to include a total of approximately 700 apartments and around 2,500 m² of commercial space. In the fourth quarter of 2025, the development portfolio was further expanded with a plot at Manufaktuuri 3, Tallinn, where approximately 300 apartments are planned to be constructed in three phases. According to the detailed plan, the plot allows for the construction of a high-rise building of up to 60 floors.

Development projects under construction and for sale

During the reporting year, the Group concluded primary sales agreements for 185 homes under the law of obligations contracts or real rights contracts, with a total value of 36.1 million euros, which is nearly twice as much as in 2024 (109 homes and 19.8 million euros). The growth was supported by a stable financial environment with stabilised interest rates and a positive economic growth outlook according to both the Estonian and Latvian central banks. In addition, several projects that had previously been in the preparation phase entered the construction stage, increasing supply volumes and expanding options for different customer segments.

As at 31 December 2025, the Group had a total of 10 residential development projects on sale, of which five had been completed and five were under construction. In completed projects, a total of 355 new homes and 453 m² of commercial space have been built. As at the reporting date, 92% of these, or 327 apartments, have been sold under real rights contracts. As at the end of the reporting year, the inventory of completed unsold apartments amounted to 28 units.

In 2025, we handed over 141 homes to customers (2024: 194 homes), including 22 homes in the fourth quarter (Q4 2024: 52 homes). In Tallinn, we handed over 91 homes to customers (2024: 165 homes) and in Riga, 50 homes (2024: 29 homes).

As at 31 December 2025, the Group had 428 new homes under construction (31 December 2024: 192) representing a 223% increase compared with the corresponding period. In Latvia 227 (31 December 2024: 40) homes were under construction and in Estonia, 201 (31 December 2024: 152).

In 2025, we commenced construction of four new development projects. In addition, the Manufaktuuri Vabriku development progressed from preparatory works to the conclusion of a construction contract, with a total value of 33.3 million euros.

In Riga, construction commenced on three separate residential development projects. At Dzelzavas iela 74C, an apartment building comprising 103 homes is under development. At Braila iela 23, a total of 105 new homes are planned across two phases, and at Eiženija iela 18, construction has begun on 54 new homes.

In Tallinn, the next phase of the Manufaktuuri quarter at Manufaktuuri 12 has started, involving the construction of two apartment buildings with a total of 49 new homes, scheduled for completion by the end of the year.

Hepsor in Canada

Hepsor’s Canadian operations focus on supporting detailed land-use planning for development projects, thereby securing increased building rights. As at 31 December 2025, the Group has invested in five development projects. In August 2025, a decision by the Toronto City Council came into effect, granting building rights for Hepsor’s first Weston Road development project. The City Council’s decision provides for the construction of two residential towers of 35 and 39 storeys. During the detailed planning process, the building volume was successfully increased from 27,000 m² to 62,000 m².

Future outlook

In 2026, the Group plans to launch construction of five new development projects – two residential and one commercial real estate project in Estonia, and one residential and one commercial real estate project in Latvia:

- V7 residential development project, located at Võistluse 7, Tallinn – Hepsor’s first residential building with a timber frame structure, comprising eight apartments;

- Paevälja quarter, stage I – construction of 93 apartments and 918 m² of commercial space at Paevälja 5, 7 and 9 is scheduled to begin in the second quarter of 2026;

- Peetri business centre, located at Vana-Tartu mnt 49, Rae Parish – the building will include 3,551 m² of leasable area, 88% of which is already covered by lease agreements;

- Veidema quarter, stage I, located at Ganību dambis 17a, Riga – a stock-office type development project combining office and warehouse functions;

- Starta 17 residential development project in Riga – construction will begin in stages, with a total of 255 new homes to be completed.

The full consolidated unaudited interim report for the IV quarter and twelve months of 2025 can be found on the Hepsor website:

https://hepsor.ee/en/for-

Consolidated statement of financial position

| in thousands of euros | 31 December 2025 | 31 December 2024 |

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | 3,821 | 6,249 |

| Trade and other receivables | 1,807 | 761 |

| Current loan receivables | 0 | 200 |

| Inventories | 58,938 | 64,141 |

| Total current assets | 64,566 | 71,351 |

| Non-current assets | ||

| Property, plant and equipment | 260 | 288 |

| Intangible assets | 0 | 2 |

| Investment properties | 11,820 | 7,980 |

| Financial investments | 7,837 | 6,424 |

| Investments in joint ventures | 26 | 0 |

| Non-current loan receivables | 6,521 | 2,428 |

| Other non-current receivables | 805 | 340 |

| Total non-current assets | 27,269 | 17,462 |

| Total assets | 91,835 | 88,813 |

| Liabilities and equity | ||

| Current liabilities | ||

| Loans and borrowings | 5,687 | 23,336 |

| Current lease liabilities | 50 | 52 |

| Prepayments from customers | 1,544 | 724 |

| Trade and other payables | 6,832 | 6,542 |

| Total current liabilities | 14,113 | 30,654 |

| Non-current liabilities | ||

| Loans and borrowings | 42,060 | 31,352 |

| Non-current lease liabilities | 112 | 162 |

| Other non-current liabilities | 8,472 | 4,635 |

| Total non-current liabilities | 50,644 | 36,149 |

| Total liabilities | 64,757 | 66,803 |

| Equity | ||

| Share capital | 3,913 | 3,855 |

| Share premium | 8,917 | 8,917 |

| Reserves | 385 | 385 |

| Retained earnings | 13,863 | 8,853 |

| Total equity | 27,078 | 22,010 |

| incl. total equity attributable to owners of the parent | 20,858 | 20,912 |

| incl. non-controlling interest | 6,220 | 1,098 |

| Total liabilities and equity | 91,835 | 88,813 |

Consolidated statement of profit and loss and other comprehensive income

| in thousands of euros | 12M 2025 | 12M 2024 | Q4 2025 | Q4 2024 |

| Revenue | 35,414 | 38,397 | 4,526 | 10,542 |

| Cost of sales (-) | -29,778 | -31,635 | -3,832 | -8,011 |

| Gross profit | 5,636 | 6,762 | 694 | 2,531 |

| Marketing expenses (-) | -1,334 | -898 | -658 | -295 |

| Administrative expenses (-) | -1,828 | -1,802 | -472 | -460 |

| Other operating income | 1,155 | 449 | 841 | 365 |

| Other operating expenses (-) | -270 | -179 | -59 | -143 |

| Operating profit (-loss) of the year | 3,359 | 4,332 | 346 | 1,998 |

| Financial income | 712 | 421 | 390 | 159 |

| Financial expenses (-) | -2,685 | -2,578 | -1,158 | -1,159 |

| Profit before tax | 1,386 | 2,175 | -422 | 998 |

| Corporate income tax | -347 | -41 | -64 | -41 |

| Net profit (-loss) for the year | 1,039 | 2,134 | -486 | 957 |

| Attributable to owners of the parent | 399 | 423 | -538 | 578 |

| Non-controlling interest | 640 | 1,711 | 52 | 379 |

| Other comprehensive income (-loss) | ||||

| Changes related to change of ownership | -81 | -313 | 0 | -389 |

| Changes in the equity of subsidiaries | 249 | 0 | 249 | 0 |

| Change in value of embedded derivatives with minority shareholders | -714 | -1,874 | -180 | -671 |

| The effects of changes in foreign exchange rates | -302 | -103 | 73 | 27 |

| Other comprehensive income (-loss) for the period | -848 | -2,290 | 142 | -1,033 |

| Attributable to owners of the parent | 491 | -504 | 72 | -330 |

| Non-controlling interest | -1,339 | -1,786 | 69 | -703 |

| Comprehensive income (-loss) for the period | 191 | -156 | -344 | -76 |

| Attributable to owners of the parent | 889 | -81 | -466 | 248 |

| Non-controlling interest | -699 | -75 | 121 | -324 |

| Earnings per share | ||||

| Basic (euros per share) | 0,10 | 0,11 | -0,14 | 0,15 |

| Diluted (euros per share) | 0,10 | 0,11 | -0,14 | 0,15 |

On 17 February 2026, a webinar of EfTEN United Property Fund was held, where Kristjan Tamla, the managing director of EfTEN Capital AS, introduced the unaudited 2025 results of EfTEN United Property Fund and discussed the plans of the fund.

On 17 February 2026, a webinar of EfTEN United Property Fund was held, where Kristjan Tamla, the managing director of EfTEN Capital AS, introduced the unaudited 2025 results of EfTEN United Property Fund and discussed the plans of the fund.

Bonds

Bonds

Täna avaldas Statistikaamet kauaoodatud tarbijahinnaindeksi info. Vastavalt värskelt avaldatud andmetele kasvasid hinnad aasta võrdluses jaanuaris 3,7%. Peamiselt vedas hinnatõusu elektri kallinemine, seda tajusid oma rahakoti peal ilmselt kõik, kes kasutavad börsihindu. Toidukaupade hinnatõus jäi tavapärasest tagasihoidlikumaks, eks osaliselt on selle taga ka täpsem hinnainfo. Kokkuvõttes on hinnatõus siiski kõrge ja loodame, et aasta teises pooles näeme madalamaid näitajaid. EL liikmesriikide seas on meiega samaväärne hinnatõus ainult Horvaatias ja Slovakkias, mujal on madalam ja jäi alla 3%. EL keskmine hinnatõus oli jaanuaris 1,7%, mis oli madalam kui oodati. Tegelikult on päris huvitav jälgida, kuidas ühest majandusindikaatorist on saanud meediastaar, millest räägitakse terve nädal pea iga päev.

Täna avaldas Statistikaamet kauaoodatud tarbijahinnaindeksi info. Vastavalt värskelt avaldatud andmetele kasvasid hinnad aasta võrdluses jaanuaris 3,7%. Peamiselt vedas hinnatõusu elektri kallinemine, seda tajusid oma rahakoti peal ilmselt kõik, kes kasutavad börsihindu. Toidukaupade hinnatõus jäi tavapärasest tagasihoidlikumaks, eks osaliselt on selle taga ka täpsem hinnainfo. Kokkuvõttes on hinnatõus siiski kõrge ja loodame, et aasta teises pooles näeme madalamaid näitajaid. EL liikmesriikide seas on meiega samaväärne hinnatõus ainult Horvaatias ja Slovakkias, mujal on madalam ja jäi alla 3%. EL keskmine hinnatõus oli jaanuaris 1,7%, mis oli madalam kui oodati. Tegelikult on päris huvitav jälgida, kuidas ühest majandusindikaatorist on saanud meediastaar, millest räägitakse terve nädal pea iga päev.

Baltic Horizon Fondi (Fond) osaku puhasväärtus (NAV) 2026. aasta jaanuari lõpu seisuga jäi samale tasemele ja oli 0,5450 eurot osaku kohta (31. detsember 2025: 0,5451). Fondi aasta lõpu kogu puhasväärtus on 78,2 miljonit eurot (31. detsember 2025: 78,2 eurot).

Baltic Horizon Fondi (Fond) osaku puhasväärtus (NAV) 2026. aasta jaanuari lõpu seisuga jäi samale tasemele ja oli 0,5450 eurot osaku kohta (31. detsember 2025: 0,5451). Fondi aasta lõpu kogu puhasväärtus on 78,2 miljonit eurot (31. detsember 2025: 78,2 eurot).

Jaanuaris aeglustus hinnatõus Eestis 3,7 ja euroalal 1,7 protsendini, olles madalaim alates 2024. aasta sügisest. Kuises võrdluses mõjutas tarbijahindu peamiselt toidu hinnatõus ja elektri hind, mis kasvas kuuga pea viiendiku külma ilmaga kaasnenud kõrge börsihinna tõttu.

Jaanuaris aeglustus hinnatõus Eestis 3,7 ja euroalal 1,7 protsendini, olles madalaim alates 2024. aasta sügisest. Kuises võrdluses mõjutas tarbijahindu peamiselt toidu hinnatõus ja elektri hind, mis kasvas kuuga pea viiendiku külma ilmaga kaasnenud kõrge börsihinna tõttu.

Statistikaameti andmetel on 2025. aastal tööturg stabiliseerunud ja töötus vähenenud, kuid muret tekitab noorte töötuse kõrge tase. Majandus- ja kommunikatsiooniministeeriumi tööhõive osakonna juhataja Kirsti Meleski sõnul on Eesti majanduse eeliseks tööturul motiveeritud ja aktiivne tööjõud, teisalt on väljakutseteks kõigile töötada soovivatele inimestele sobiva ja kvaliteetse töö leidmine ning tööandjatele vajalike oskustega tööjõu tagamine.

Statistikaameti andmetel on 2025. aastal tööturg stabiliseerunud ja töötus vähenenud, kuid muret tekitab noorte töötuse kõrge tase. Majandus- ja kommunikatsiooniministeeriumi tööhõive osakonna juhataja Kirsti Meleski sõnul on Eesti majanduse eeliseks tööturul motiveeritud ja aktiivne tööjõud, teisalt on väljakutseteks kõigile töötada soovivatele inimestele sobiva ja kvaliteetse töö leidmine ning tööandjatele vajalike oskustega tööjõu tagamine.

Tarbijahinnad saavutasid Eestis tipu möödunud aasta augustis ja on sealt alates allapoole liikunud. Kuigi tänavu jaanuaris tegi hinnakasv kuises võrdluses 1% tõusu, jätkus aastases võrdluses selle aeglustumine (3,7%).

Tarbijahinnad saavutasid Eestis tipu möödunud aasta augustis ja on sealt alates allapoole liikunud. Kuigi tänavu jaanuaris tegi hinnakasv kuises võrdluses 1% tõusu, jätkus aastases võrdluses selle aeglustumine (3,7%). Tallinna südalinna Kompassi asumisse kerkiva 16-korruselise eluhoone Stellar arenduses lõpetati edukalt 0-tsükli ehitustööd ning projekt liigub edasi maapealsesse ehitusfaasi. Novira Capitali ja Evernordi poolt 54 miljoni euroga rajatav modernne eluhoone valmib 2027. aasta suvel.

Tallinna südalinna Kompassi asumisse kerkiva 16-korruselise eluhoone Stellar arenduses lõpetati edukalt 0-tsükli ehitustööd ning projekt liigub edasi maapealsesse ehitusfaasi. Novira Capitali ja Evernordi poolt 54 miljoni euroga rajatav modernne eluhoone valmib 2027. aasta suvel.

Statistikaameti teatel ulatus tarbijahinnaindeksi aastakasv jaanuaris 3,7%ni. Hinnakasvu mõjutas peamiselt elektri kallinemine. Kui jätta elektri hinnatõus kõrvale, kallines ülejäänud tarbijakorv aastaga 2,9%.

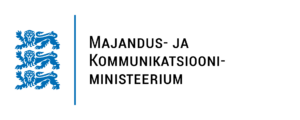

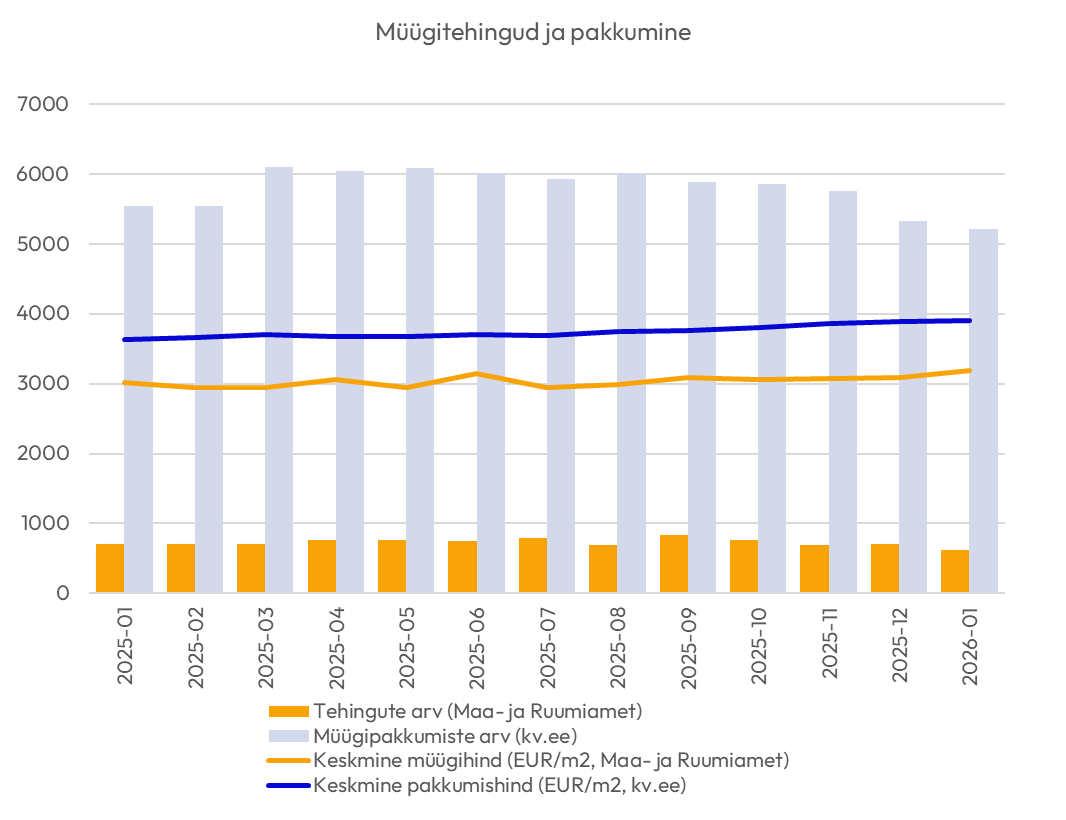

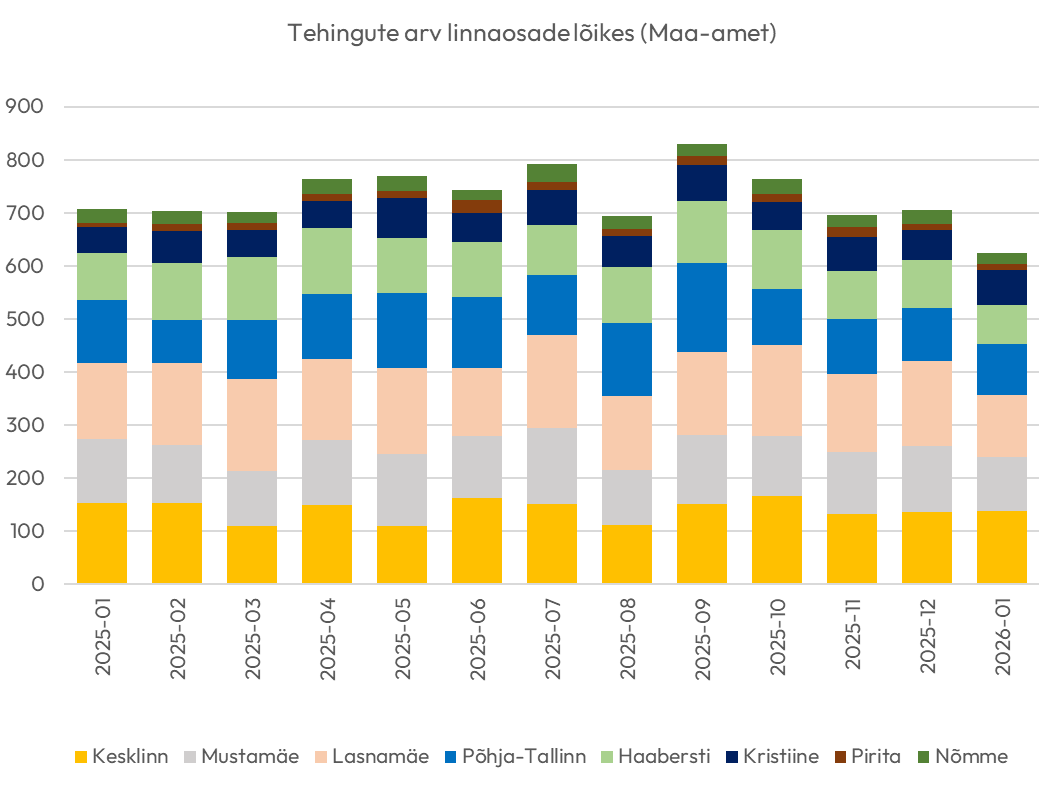

Statistikaameti teatel ulatus tarbijahinnaindeksi aastakasv jaanuaris 3,7%ni. Hinnakasvu mõjutas peamiselt elektri kallinemine. Kui jätta elektri hinnatõus kõrvale, kallines ülejäänud tarbijakorv aastaga 2,9%. Maa- ja Ruumiameti andmetel tehti Tallinnas 2026. aasta jaanuaris 625 korteriomandi müügitehingut. Võrreldes 2025. aasta jaanuariga ning 2025. aasta detsembriga on tehingute arv ligikaudu 11% madalam. Samas on aktiivsus selgelt kõrgem kui kahel varasemal aastal – 2024. aasta jaanuaris sõlmiti 540 ning 2023. aasta jaanuaris 457 korteritehingut.

Maa- ja Ruumiameti andmetel tehti Tallinnas 2026. aasta jaanuaris 625 korteriomandi müügitehingut. Võrreldes 2025. aasta jaanuariga ning 2025. aasta detsembriga on tehingute arv ligikaudu 11% madalam. Samas on aktiivsus selgelt kõrgem kui kahel varasemal aastal – 2024. aasta jaanuaris sõlmiti 540 ning 2023. aasta jaanuaris 457 korteritehingut.

Kliimaministeerium ja Euroopa Investeerimispank (EIB) alustasid koostööd taskukohaste ja kvaliteetsete elamispindade kättesaadavuse suurendamiseks. Eesmärk on välja töötada finantseerimislahendus, mis aitab maandada erasektori arendajate riske ka väljaspool suuremaid linnu.

Kliimaministeerium ja Euroopa Investeerimispank (EIB) alustasid koostööd taskukohaste ja kvaliteetsete elamispindade kättesaadavuse suurendamiseks. Eesmärk on välja töötada finantseerimislahendus, mis aitab maandada erasektori arendajate riske ka väljaspool suuremaid linnu. Tallinna südalinna, Admiraliteedi basseini äärde rajatav elamu- ja ärikvartal Talsinki sai ehitusloa. Kvartalit arendab Urmas Sõõrumaa ettevõte US Real Estate. Valmimine on kavandatud etapiliselt aastatel 2028-2029.

Tallinna südalinna, Admiraliteedi basseini äärde rajatav elamu- ja ärikvartal Talsinki sai ehitusloa. Kvartalit arendab Urmas Sõõrumaa ettevõte US Real Estate. Valmimine on kavandatud etapiliselt aastatel 2028-2029.

Tartu kesklinnas Emajõe kaldal asuvale Turu 18 kinnistule ehitavad Giga ja Merko kolm äripindadega kortermaja, naaberkinnistule on plaanitud hotelli- ja büroohoone rajamine. Uus linnakvartal hakkab kandma Uus-Karlowa nime.

Tartu kesklinnas Emajõe kaldal asuvale Turu 18 kinnistule ehitavad Giga ja Merko kolm äripindadega kortermaja, naaberkinnistule on plaanitud hotelli- ja büroohoone rajamine. Uus linnakvartal hakkab kandma Uus-Karlowa nime.