Oma maja ehitamisel on alati kõige raskemad esimesed sammud, millest alustada ja kuidas võimalikult efektiivselt ja kvaliteetselt ehitusprotsessi juhtida? Siinkohal nõuanded, mis seda teekonda veidi lihtsustavad ja aitavad olulisematele teemadele tähelepanu juhtida.

Oma maja ehitamisel on alati kõige raskemad esimesed sammud, millest alustada ja kuidas võimalikult efektiivselt ja kvaliteetselt ehitusprotsessi juhtida? Siinkohal nõuanded, mis seda teekonda veidi lihtsustavad ja aitavad olulisematele teemadele tähelepanu juhtida.

1. Projekti kvaliteet määrab ka suuresti ehituskvaliteedi

Tellija peaks võimalusel olema alati kaasatud projekteerimise faasis, seda nii selleks, et anda tagasiside funktsionaalse ruumiplaani ja arhitektuurse väljanägemise osas, kuid ka selleks, et küsida projekteerijalt “Kas ehitaja saab selle projekti järgi ehitada?”

Üldjuhul levinud ja populaarne “eelprojekti” staadiumis projekt ei sisalda kogu ehitamiseks vajalikku infot ja soovitavalt tuleks, kas tellida detailsem “põhiprojekt” ja/või keerulisemate sõlmede osas vajadusel ka “tööprojekt”.

Tellijal otsustab projekti detailsuse valimisega ka selle, kui selgelt ja üheselt on välja toodud ehitustööde sisu, konstruktiivsed lahendused ehk kokkuvõttes selle, mille alusel on võimalik kontrollida ehitustööde teostamist ja nende kvaliteeti.

2. Ehitustööde hinnapakkumine ei sisalda enamasti kõiki töid

Tellijad eeldavad ekslikult, et kui nad esitavad ehitajale projekti ja paluvad hinnapakkumist siis saadud hinnapakkumises on kõik ehitustöödeks vajalik sisse arvestatud. Tegelikkuses isegi “võtmed kätte” majade hinnapakkumistes on tavaliselt osa töid puudu.

Hinnapakkumise puhul tuleks arvestada, et teostamisele kuuluvad ainult need selgelt väljatoodud tööd, mis on pakkumises kirjas. Keerukaks teebki tellijale pakkumise hindamise just see, et puudub erialane teadmine ja kogemus, mis tööd lisaks pakkumises toodule oleks veel vajalikud.

Tellija peaks saadud hinnapakkumise põhjalikult läbi töötama koos ehitajaga ning selgeks tegema, mis täpselt pakkumises sisaldub, küsides aga pidevalt “Kas konkreetses töölõigus on veel puudu töid, mis hetkel pakkumises ei sisalda?” Kui seda ei tehta siis on hiljem ehitusfaasis tavaliselt ootamas pealesunnitud lisakulud, millega ei osatud arvestada.

3. Hinnapakkumises toodud viimistlusmaterjalide ja -toodete hinnaklass ei pruugi tellijale sobida

Ehitaja poolt esitatavates hinnapakkumistes on toodud välja sageli näiteks parkettpõrand, siseuksed, liistud, aknalauad, keraamilised plaadid, sanitaartehnika, kas konkreetse töölõigu osas tervikhinnaga /komplekti hinnaga või kasutatakse m2 hinda, millega täpsustatakse teatud materjalid osas m2 piirhinnad.

Probleem seisneb selles, et tellija ei vaata hinnapakkumises väljatoodud materjalide hindade alusel tavaliselt, kas hinnapakkumises toodud materjali hinnaga saab soovitud kvaliteedi ja väljanägemisega lõpptulemuse. Tavaliselt vaadatakse tellija poolt, et tööga seotud rida oleks hinnapakkumises olemas, kuid ei tehta sisulist materjalide/toodete hinna analüüsi.

Tulemuseks olukord, kus sõlmitakse ehitusleping ja alustatakse töödega ning tööde käigus ja enamasti just lõpufaasis hakkab selguma, et hinnapakkumises toodud hinnaga viimistlusmaterjale ei sooviks mitte mingil juhul oma maja puhul kasutada. Tulemuseks lisakulud ja ajaplaani nihkumine, sest kallimate materjalide hanked on tavaliselt pikema tarneajaga.

Seetõttu tasub tellijal alati hinnata kohe hinnapakkumise saamisel, kas pakkumises väljatoodud materjalid on tema maitsele ja soovidele vastavad. Tuleks käia enne ehituslepingu sõlmimist ehituspoodides ja veenduda, kas näiteks hinnapakkumises toodud m2 hinnaga keraamiliste plaatide kvaliteet ja valik on sobilik või soovitakse parema väljanägemisega interjööri tarvis kallima hinnaklassiga siseviimistluse tooteid.

Pööra nii projekteerimise kui ka hinnapakkumises staadiumis tähelepanu eeltoodud nõuannetele ja saad vastu ehitusfaasis kiirema ja sujuvama ehitamise.

Artikli autor on

Artikli autor on

Eno Pappel

Majaehitaja.ee

Mustamäe on oma 68 000 elanikuga üks Tallinna parima mikrokliimaga elupiirkondi, kus on palju parke ja rohealasid, kirjutab Arco Vara maakler Dmitri Bekker.

Mustamäe on oma 68 000 elanikuga üks Tallinna parima mikrokliimaga elupiirkondi, kus on palju parke ja rohealasid, kirjutab Arco Vara maakler Dmitri Bekker.

Meil on päevakorras ühistu asutamine, aga nüüd selgus, et meil on endiselt kaasomand ja korteriomanditeks pole jagatud. Kas ühistu loomiseks on vaja kindlasti esmalt vormistada korteriomand? Tean, et korteriomandiks vormistamiseks peavad kõik majaelanikud minema notarisse oma nõusolekut kinnitama. Kuidas tavapäraselt selline olukord korraldatud on?

Meil on päevakorras ühistu asutamine, aga nüüd selgus, et meil on endiselt kaasomand ja korteriomanditeks pole jagatud. Kas ühistu loomiseks on vaja kindlasti esmalt vormistada korteriomand? Tean, et korteriomandiks vormistamiseks peavad kõik majaelanikud minema notarisse oma nõusolekut kinnitama. Kuidas tavapäraselt selline olukord korraldatud on?

Valitsus kiitis tänasel istungil heaks muudatuse, millega kaotatakse looduskaitsealuste maade riigile omandamise määrusest erisus ning edaspidi lähtutakse ka linnades, alevikes ja parkides asuvate kinnisasjade puhul kaitsekorrast tulenevate piirangute ulatusest ja olulisusest.

Valitsus kiitis tänasel istungil heaks muudatuse, millega kaotatakse looduskaitsealuste maade riigile omandamise määrusest erisus ning edaspidi lähtutakse ka linnades, alevikes ja parkides asuvate kinnisasjade puhul kaitsekorrast tulenevate piirangute ulatusest ja olulisusest.

Paljud kortermajad vahetavad muutuva seaduse raames majahaldureid ja hoonete ülevaatusel on selgunud, et hulk ühistud üle Eesti on maksnud majahalduritele teenuste eest tühja.

Paljud kortermajad vahetavad muutuva seaduse raames majahaldureid ja hoonete ülevaatusel on selgunud, et hulk ühistud üle Eesti on maksnud majahalduritele teenuste eest tühja.

Nagu paljudes Eesti suuremates linnades, on ka Pärnus oma suurem paneelmajade piirkond, mille mõju kohalikule kinnisvaraturule ei saa sugugi alahinnata, kirjutab Arco Vara maakler Gätlin Vesset.

Nagu paljudes Eesti suuremates linnades, on ka Pärnus oma suurem paneelmajade piirkond, mille mõju kohalikule kinnisvaraturule ei saa sugugi alahinnata, kirjutab Arco Vara maakler Gätlin Vesset.

Ober-Hausi Kinnisvara korterite hinnaindeks langes jaanuaris pärast kahte kuud kestnud tõusu ja oli võrreldes detsembriga 0,5% madalamal. Võrreldes 2016. a jaanuariga oli indeks 8,2% kõrgemal.

Ober-Hausi Kinnisvara korterite hinnaindeks langes jaanuaris pärast kahte kuud kestnud tõusu ja oli võrreldes detsembriga 0,5% madalamal. Võrreldes 2016. a jaanuariga oli indeks 8,2% kõrgemal. Põhja-Tallinna Valitsus, Tallinna Kesklinna Valitsus ja Tallinna Linnaplaneerimise Amet korraldavad Tallinna linnahalli ja lähiala detailplaneeringu avaliku väljapaneku, detailplaneeringuga saab tutvuda 8. märtsist kuni 6. aprillini.

Põhja-Tallinna Valitsus, Tallinna Kesklinna Valitsus ja Tallinna Linnaplaneerimise Amet korraldavad Tallinna linnahalli ja lähiala detailplaneeringu avaliku väljapaneku, detailplaneeringuga saab tutvuda 8. märtsist kuni 6. aprillini.

15. veebruaril 2017 sõlmiti AS Merko Ehitus kontserni kuuluva AS Merko Infra ja AS Elering vahel leping Sindi 110kV jaotusseadme renoveerimistööde teostamiseks Pärnu maakonnas Eestis.

15. veebruaril 2017 sõlmiti AS Merko Ehitus kontserni kuuluva AS Merko Infra ja AS Elering vahel leping Sindi 110kV jaotusseadme renoveerimistööde teostamiseks Pärnu maakonnas Eestis.

Keskmise palga kiire tõus ajal, kui majanduskasv on äärmiselt aeglane, on tõstatanud küsimuse, kas peagi on tööturul oodata pööret halvemuse suunas. Viimased andmed näitavad tööturgu siiski positiivses valguses. Seetõttu ei peaks tööjõu-teemalised diskussioonid keskenduma maksudele, vaid võimalustele, kuidas Eesti napp tööjõud võimalikult tarka tööd tegema panna.

Keskmise palga kiire tõus ajal, kui majanduskasv on äärmiselt aeglane, on tõstatanud küsimuse, kas peagi on tööturul oodata pööret halvemuse suunas. Viimased andmed näitavad tööturgu siiski positiivses valguses. Seetõttu ei peaks tööjõu-teemalised diskussioonid keskenduma maksudele, vaid võimalustele, kuidas Eesti napp tööjõud võimalikult tarka tööd tegema panna.

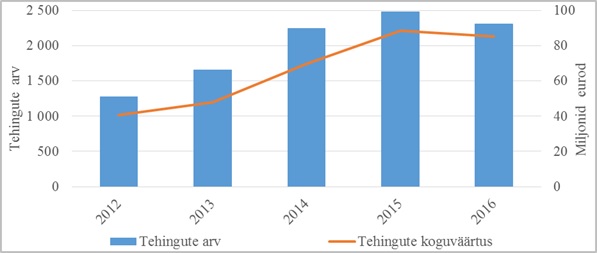

Hoonestamata elamumaaga tehtud tehingute arv langes 2016. aastal 6,7% võrreldes 2015. aastaga. Tehingute koguväärtus on samal ajal langenud vaid 3,9%. Enim mõjutas 2016. aastal hoonestamata elamumaa tulemusi tehingute arvu vähenemine Harju maakonnas ning juriidiliste isikute vähene tehinguaktiivsus võrreldes 2015. aastaga.

Hoonestamata elamumaaga tehtud tehingute arv langes 2016. aastal 6,7% võrreldes 2015. aastaga. Tehingute koguväärtus on samal ajal langenud vaid 3,9%. Enim mõjutas 2016. aastal hoonestamata elamumaa tulemusi tehingute arvu vähenemine Harju maakonnas ning juriidiliste isikute vähene tehinguaktiivsus võrreldes 2015. aastaga.

06/03/2017 toimub Kinnisvarakoolis uus koolitus “Kinnisvaraturundus ja kommunikatsioon internetis ning tavameedias”. Kinnisvaravaldkonna turunduskommunikatsioonile keskenduvat koolitust loeb kinnisvaraanalüütik Tõnu Toompark. Internetiturunduse osa tutvustab Dreamgrow digiagentuuri asutaja ja strateeg Priit Kallas.

06/03/2017 toimub Kinnisvarakoolis uus koolitus “Kinnisvaraturundus ja kommunikatsioon internetis ning tavameedias”. Kinnisvaravaldkonna turunduskommunikatsioonile keskenduvat koolitust loeb kinnisvaraanalüütik Tõnu Toompark. Internetiturunduse osa tutvustab Dreamgrow digiagentuuri asutaja ja strateeg Priit Kallas.

Rohelist, kuid samas soodsat elektrienegiat pakkuv tööstuspark otsib üürilisi tootmise, logistika või IT sektorist.

Rohelist, kuid samas soodsat elektrienegiat pakkuv tööstuspark otsib üürilisi tootmise, logistika või IT sektorist.