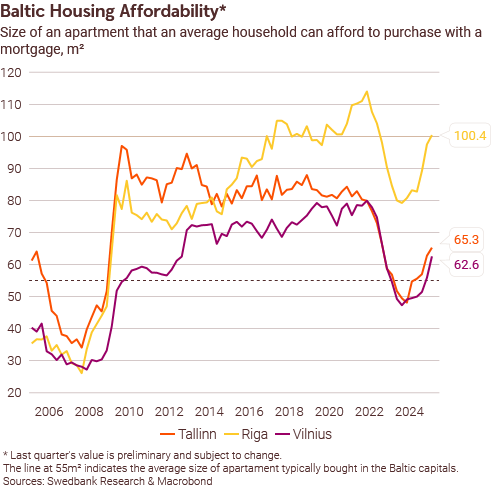

Declining interest rates and solid wage growth, especially in Riga and Vilnius, increased housing affordability.

Declining interest rates and solid wage growth, especially in Riga and Vilnius, increased housing affordability.- The ECB could cut rates three more times this year, which will support affordability going forward.

Housing markets in the Baltic capitals seem to be faring well against the backdrop of skyrocketing global uncertainty. Easing inflation pressures in the eurozone have allowed the ECB to cut interest rates three times since January. Wage growth confidently outpaced apartment price increases, especially in Riga and Vilnius. This has improved housing affordability in the first quarter for all three capitals.

Market activity remained relatively high, with most transactions concentrated in the secondary market. The situation in the primary market is varied, though. Activity in the Vilnius primary market has doubled year on year, and Riga finally seems to be emerging from a slump. Tallinn will also likely follow suit, but it is taking longer there for the primary market recovery to start.

Swedbank forecasts three more rate cuts by the ECB, reducing the deposit rate to 1.5% at the end of 2025 (markets currently price in two cuts). Lower rates will support affordability in all Baltics. In Latvia and Lithuania, net wage growth will provide an additional boost to affordability, while net wages in Estonia will see only limited growth. Improving economic activity might lift consumer confidence and could also support housing market activity going forward.