The impact of falling interest rates is fading.

The impact of falling interest rates is fading.- Policy changes and rising net incomes will continue to support market activity in 2026.

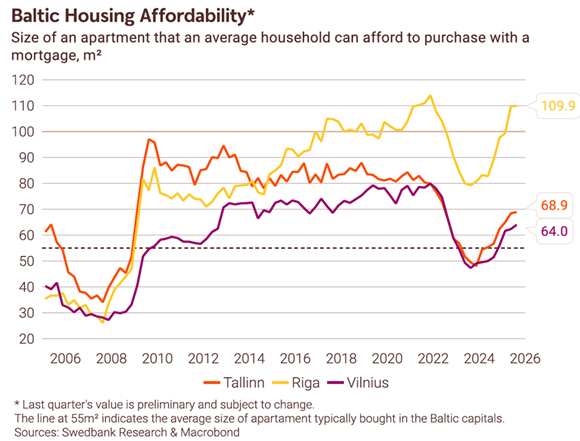

Housing affordability saw only a marginal improvement in the third quarter of 2025, which comes as no surprise. With no changes in ECB interest rates since June, net wage growth remained the main driver of affordability. The good news is that net wages continue to outpace apartment price growth. While the 2021 peak in affordability is close for Riga, it will take time for the neighbouring capitals to make a full recovery, if at all possible given current trends.

Market activity remained high, although below the record levels seen after Covid-19 in Tallinn and Vilnius. In Riga, however, activity recently reached its highest level since 2007. As before, most deals are concentrated in the larger secondary markets, while in Vilnius and Riga primary markets are also strong. Mortgage lending is soaring at a pace last observed nearly 20 years ago, and consumer confidence showed a notable improvement in October.

Swedbank forecasts just one more rate cut by the ECB in the current cutting cycle, leaving the main policy rate at 1.75% in March. Net wage growth is expected to continue easing, except for Estonia, where the upcoming tax reform will notably boost net incomes. In Lithuania, the option to withdraw retirement savings from the second-pillar pension funds will give a temporary lift to both the Lithuanian economy and the housing market.