The housing affordability index (HAI) slipped as abnormal price growth gained momentum.

The housing affordability index (HAI) slipped as abnormal price growth gained momentum.- Falling affordability and purchasing power, as well as bleak expectations, are likely to curb demand and stifle price growth.

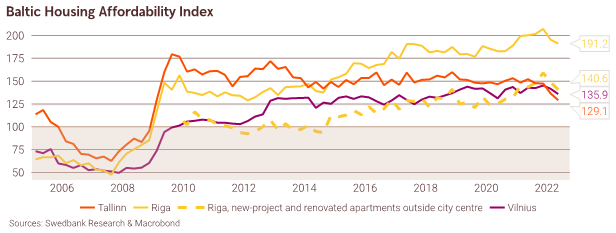

The record-high housing affordability that we have seen over the previous years has dropped in all the Baltic capitals. In Tallinn, the HAI is already at its lowest level since 2008. In Riga and Vilnius, the index is weaker but close to the pre-pandemic levels of 2017-2019.

The reasons for weakening housing affordability are the same in all three Baltic capitals – steep apartment price growth. The still-rapid wage growth cannot keep up with apartment price growth anymore. The prices in the primary housing market have risen on the back of soaring construction costs and the pandemic-induced shortage of new apartments. Meanwhile, very strong demand has overspilled into the secondary market as well and pushed prices of old apartments higher.

However, the outlook is darkening, and recession is around the corner, forcing the housing market to cool down. High apartment prices and the increase of Euribor rates will further outweigh wage growth and deteriorate housing affordability. The affordability of apartments is also being affected by enormous consumer price inflation, leaving households with eroded purchasing power. Given these circumstances and the abnormal price growth, demand for housing is likely to decrease, while supply will hold up or even increase going forward. Hence, we are likely to see some correction in prices, at least in Estonia and Lithuania, as the markets look heated.